EXPIRATION

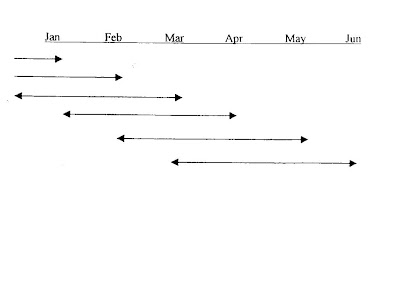

In Sensex and nifty futures we have three monthly contracts running at a time. Current month and next two months. They are identified by the calendar months like June futures,

July futures, August futures etc.

Last day of futures contract is know as expiration date. Sensex and Nifty futures expire on last Thursday of every month (or previous day if Thursday is a holiday) and from

the next trading day, a new month contract starts.

SERIES

A futures contract belongs to a particular series. One series belongs to a particular month.

E.g. Nifty index futures series for April or May etc. Nifty series is coded as below –

FUT IDX NIFTY 24-April-2008 Here, not only month, but expiry date is also available.

Sensex series is coded as below : BSX APR 2008

BASIS

Basis = Spot price – futures price.

In normal market, basis is negative, i.e. futures price is greater than spot price. Negative basis reflects upward expectations about the market. In inverted markets, Basis can be positive i.e. futures price is lower than spot price. Positive basis reflects downward expectations about the market. Basis can be positive in commodity markets, where commodity is in short supply and hence spot price is high.

In Sensex and nifty futures we have three monthly contracts running at a time. Current month and next two months. They are identified by the calendar months like June futures,

July futures, August futures etc.

Last day of futures contract is know as expiration date. Sensex and Nifty futures expire on last Thursday of every month (or previous day if Thursday is a holiday) and from

the next trading day, a new month contract starts.

SERIES

A futures contract belongs to a particular series. One series belongs to a particular month.

E.g. Nifty index futures series for April or May etc. Nifty series is coded as below –

FUT IDX NIFTY 24-April-2008 Here, not only month, but expiry date is also available.

Sensex series is coded as below : BSX APR 2008

BASIS

Basis = Spot price – futures price.

In normal market, basis is negative, i.e. futures price is greater than spot price. Negative basis reflects upward expectations about the market. In inverted markets, Basis can be positive i.e. futures price is lower than spot price. Positive basis reflects downward expectations about the market. Basis can be positive in commodity markets, where commodity is in short supply and hence spot price is high.